ny paid family leave tax category

State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2. New Yorks states Paid Family Leave PFL program provides workers with job-protected paid leave to bond with a new child care for a loved one with a serious health condition or to help relieve family pressures when someone is.

New York Paid Family Leave Updates For 2022 Paid Family Leave

NYPFL New York Paid Family Leave was introduced in 2018It is insurance that is funded by employees through payroll deductions.

. You may request voluntary tax. Set up the NY. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program has tax implications for New York employees employers and insurance carriers including self-insured employers employer.

Your PFL benefits are taxable. After discussions with the Internal Revenue Service and its review of other legal sources the New York Department of Taxation and Finance issued guidance regarding the tax implications of its new paid family leave program. In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

They are however reportable as income for IRS and NYS tax purposes. Paid Family Leave may also be available. The original Turbo Tax answer about a year ago to this question was incorrect which is why I responded as I did with the correct info and the NYS link stating that NYPFL is a.

If an employer chooses to hire a temporary employee to replace a regular employee while they are on Paid Family Leave could. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum annual contribution of 38534. Nlu4v68qdnluwm Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

What category description should I choose for this box 14 entry. Employees earning less than the Statewide Average Weekly Wage SAWW. New York paid family leave benefits are taxable contributions must be made on after-tax basis.

Pursuant to the Department of Tax Notice No. Fully Funded by Employees. Paid Family Leave provides eligible employees job-protected paid time off to.

Set the appropriate NY rates for Family Leave Rate and Family Leave Wage Base. Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. Confirm the clients state is NY. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2.

Paid Family Leave benefits are not subject to employee or employer FICA FUTA or SUTA. The maximum annual contribution is 42371. N-17-12 PDF Paid Family Leave contributions are deducted from employees after-tax wages.

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave.

This amount is be deducted from employees post-tax income and is appear on their paystubs as a post-tax deduction. Employees can request voluntary tax withholding. Employers may collect the cost of Paid Family Leave through payroll deductions.

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

Cost And Deductions Paid Family Leave

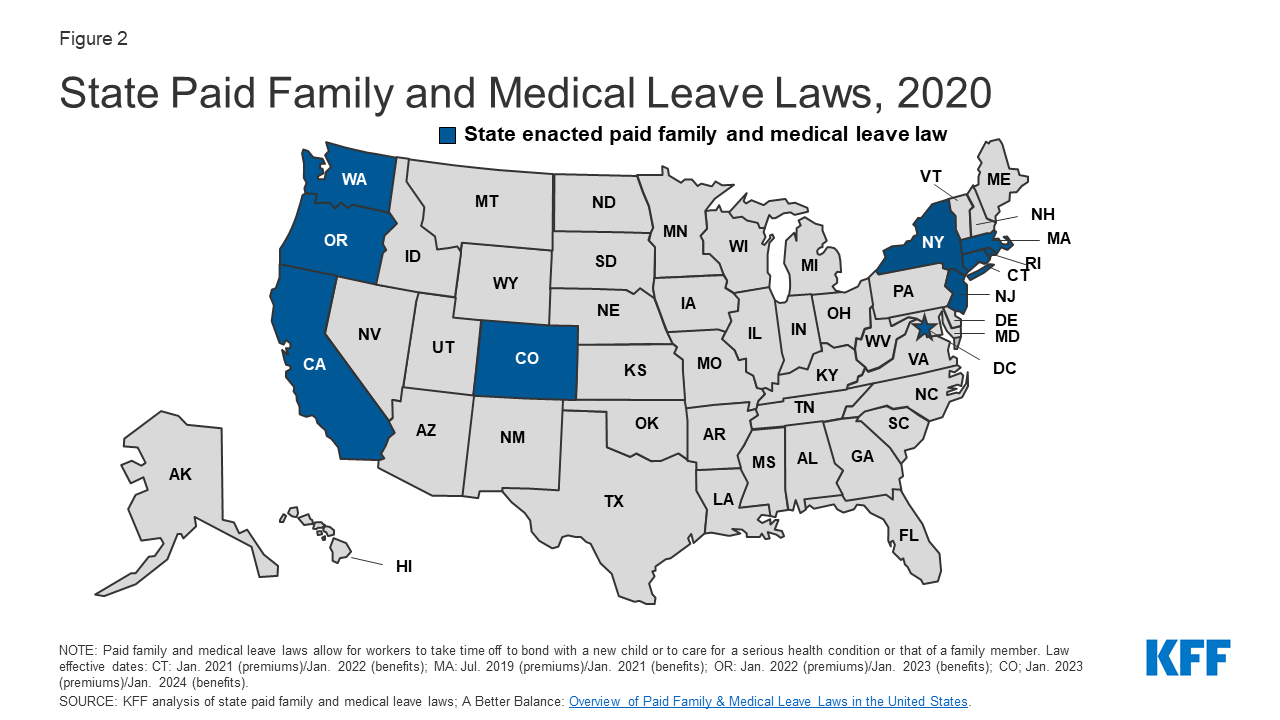

Paid Family And Medical Leave In The United States A Research Agenda Equitable Growth

Implications Of Allowing U S Employers To Opt Out Of A Payroll Tax Financed Paid Leave Program Equitable Growth

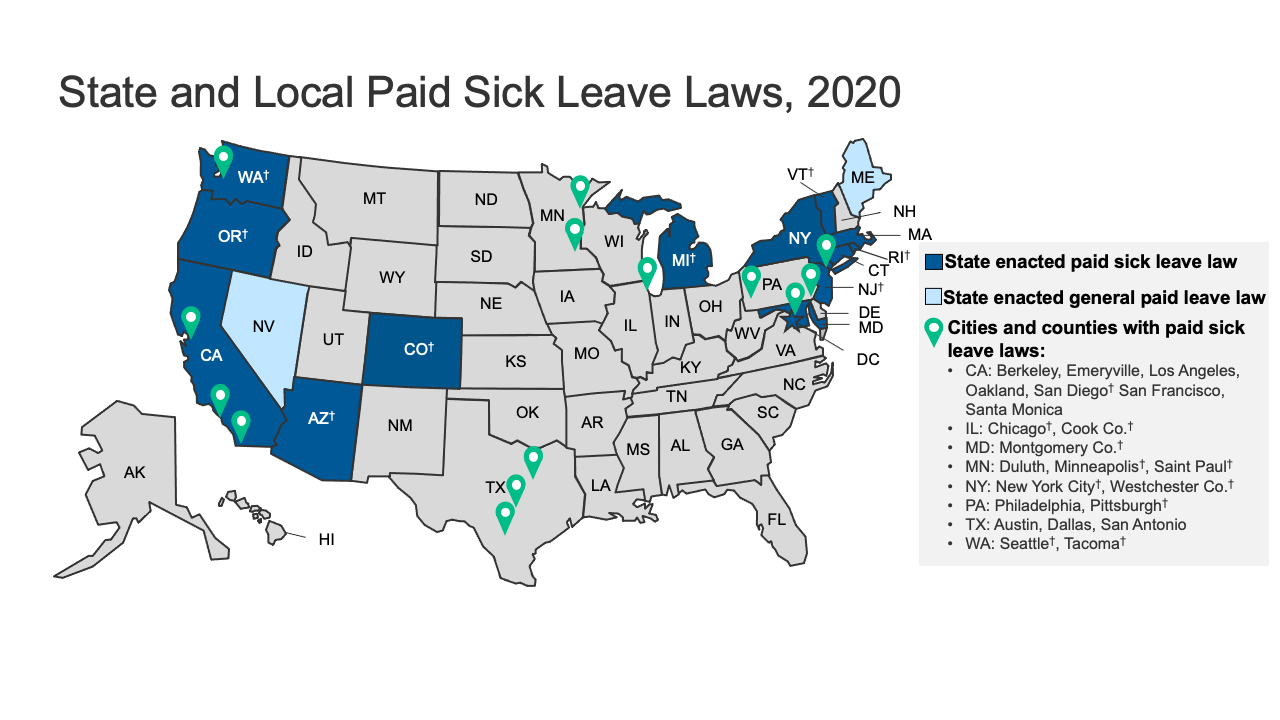

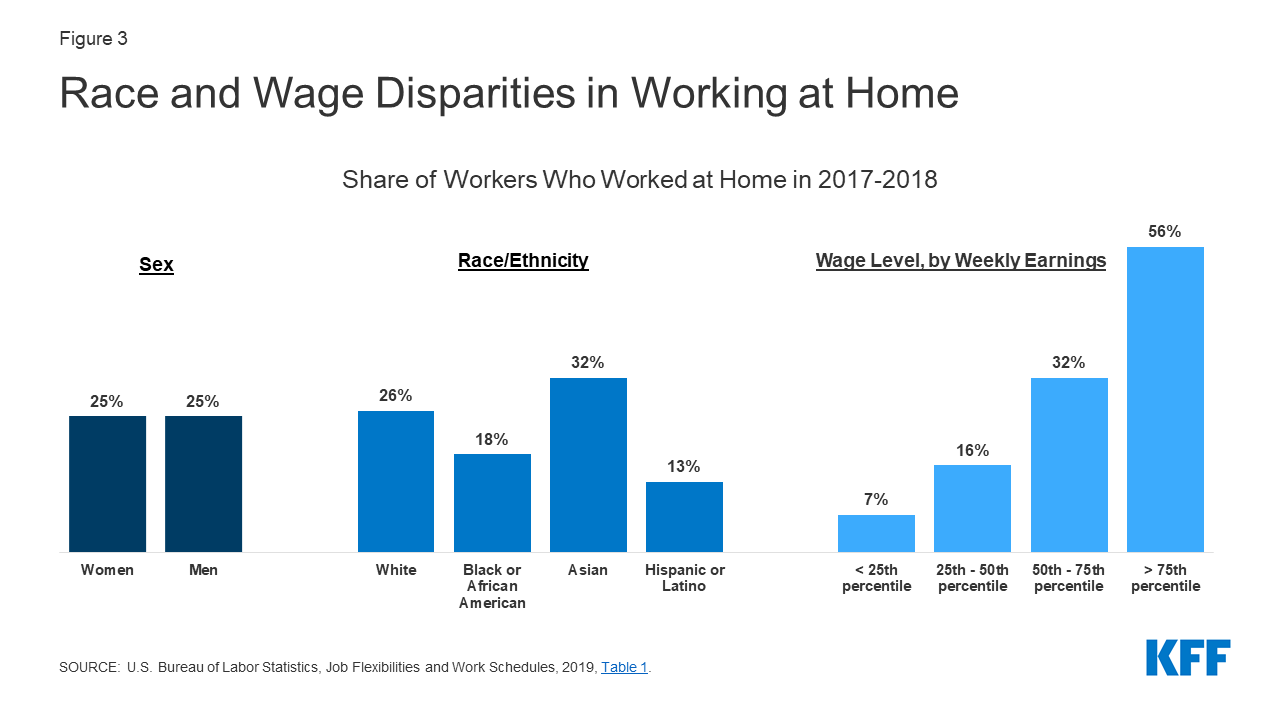

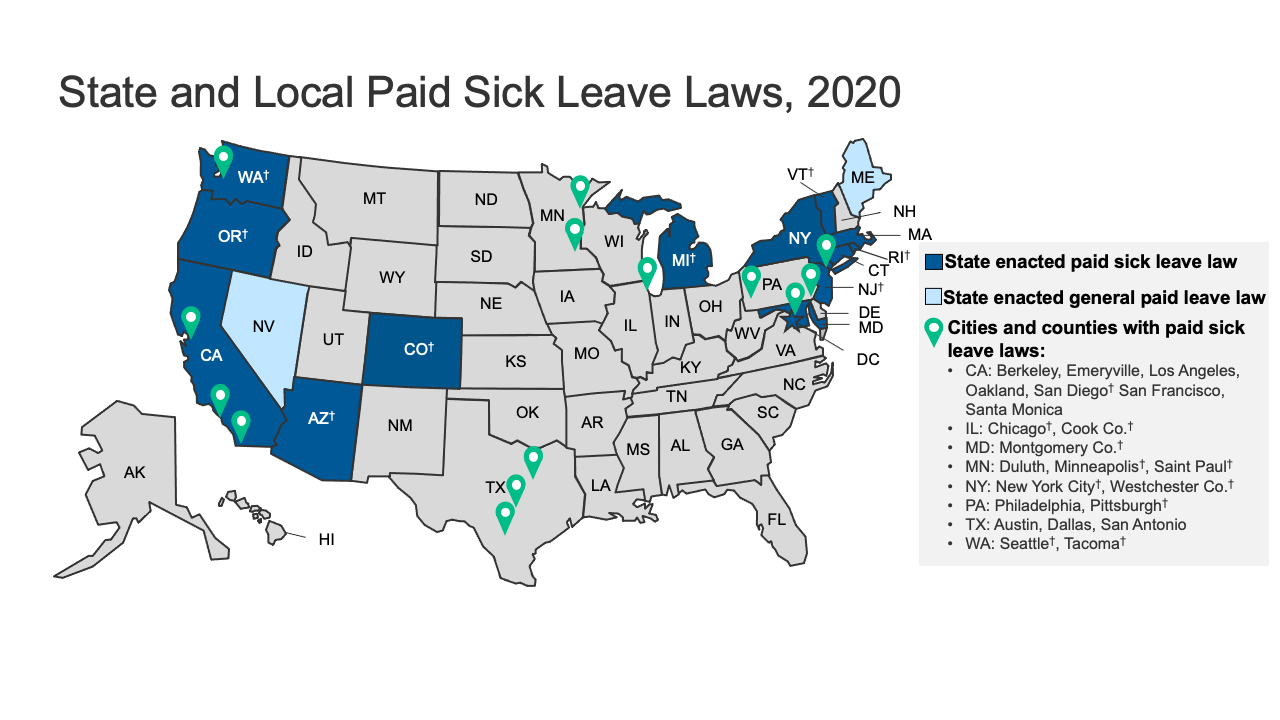

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Time Off To Care State Actions On Paid Family Leave

New National Paid Leave Proposals Explained

Paid Family Leave For Family Care Paid Family Leave

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Time Off To Care State Actions On Paid Family Leave

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries